Prepare & E-File 2023 Form 1099-INT Quickly & Securely

- Error-Free Filing

- State Filing

- Postal Mail Recipient Copies

Due Dates for Filing 1099 Forms for Tax Year 2023

Provide Recipient Copies

January 31, 2024

Paper Filing Deadline

February 28, 2024

E-Filing Deadline

April 01, 2024

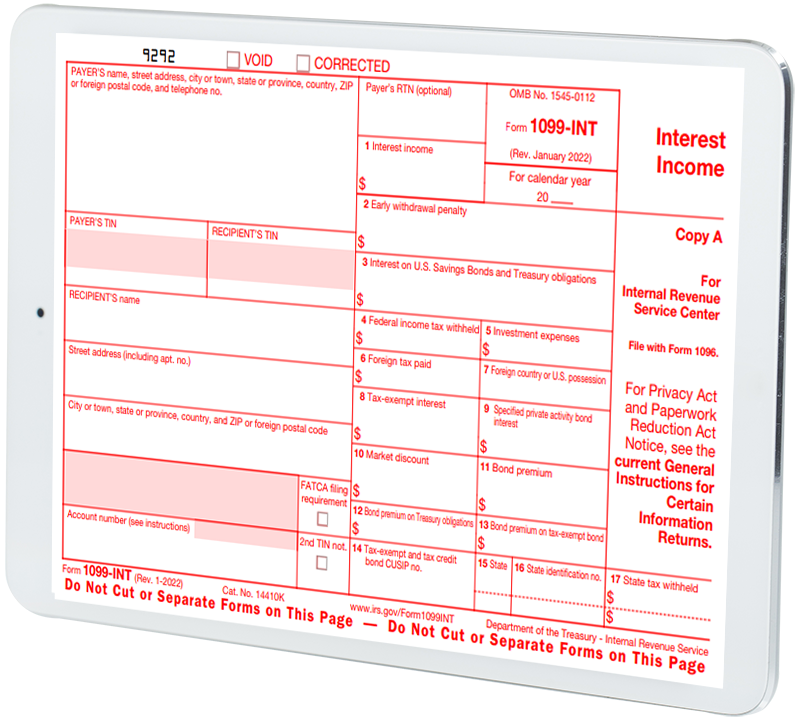

What is Form 1099-INT?

Form 1099-INT is an annual tax statement furnished by payers of interest income greater than $10 including expenses associated with the payment. 1099 Forms are required to be filed with the IRS on a yearly basis.

To learn more about Form 1099-INT - visit: https://www.taxbandits.com/1099-forms/efile-form-1099-int-online/

What is New in 1099 Forms for 2023 Tax Year?

For the 2023 Tax year, the IRS has reintroduced Form 1099-NEC. For many years the Form 1099-MISC with nonemployee compensation has been due to the IRS by January 31, however, other types of payments weren’t due until March. The purpose of Form 1099-NEC is to eliminate the confusion of one form having two different deadlines. If the payers have paid at least $600 of nonemployee compensation to an independent contractor/vendor, they should report on Form 1099-NEC which was previously reported on Box 7 of 1099-MISC.

Why form1099int.com is the #1 E-Filing Solution?

We have taken the time to provide a safe and secure e-filing program that will help you file 1099-INT Forms online in few minutes. With form1099int.com, you can e-file 1099 Forms federally and with the necessary states as well. Our helpful e-filing guide explains exactly how to e-file and what information is required to complete the form. Plus our bulk upload, postal mailing, Print Center and more make the entire process incredibly convenient. Our US based support team can be reached at (704) 684-4751, by live chat, or by 24/7 e-mail support.

Also You can e-filing 1099 Forms (1099-DIV, 1099-MISC, 1099-B, 1099-K, 1099-R, 1099-S, 1099-G, 1099-Q), Form W-2 & W-2c, ACA Forms (1095-B & 1095-C), 941 Forms (941, 941-PR, 941-SS), 990 Forms (990, 990-N, 990-EZ, 990-PF & 1120-POL) too conveniently from the same account.

Form1099int.com Features

Form 1099-INT Corrections

If your Form 1099-INT is rejected by the IRS, don't worry. We will instantly let you know. Then you can correct your 1099-INT form as soon as possible and retransmit it to the IRS. Just choose the type of correction you need to make and include the previously reported information with the correction information.

1099-INT State Filings

Depending on your state you may need to e-file Form 1099-INT with the applicable state department and include additional information. Some states will forward your information from the IRS if they are in the CF/SF program, but others require you to file.

Form 1099-INT Extension

If you're too busy to file Form 1099-INT by the deadline simply get a form extension! By e-filing Form 8809 by the deadline on January 31st you will automatically receive a 30-day extension to file Form 1099-INT. The process is fast, easy, and your extension will be instantly approved!

Required Information To File Form 1099-INT Online

In order to complete Form 1099-INT online you will need to provide the following information:

- Payer Information: Name, TIN, and Address

- Recipient Information: Name, TIN/SSN, and Address

- Federal Information: Federal Interest and Income and Federal Tax Withheld

- State Filing Information: State Income. Payer State Number, and State Tax Withheld

Steps To E-File 1099-INT

E-filing Form 1099-INT is incredibly easy thanks to our innovative 1099 reporting software. Just refer to the following instructions:

- Create your free account using your email address and by creating your personal password and select 'New 1099-INT Form'.

- Enter your Payer Information, including the Name, TIN, and Address.

- Enter your Recipient Information, including the Name, TIN/SSN, and Address.

- Enter Amounts such as your Federal Interest Income, Federal Tax Withheld, State Income, and State Tax Withheld.

- Review your form, pay for it, and transmit it directly to the IRS.

Form 1099-INT Penalties

If you fail to e-file Form 1099-INT by the deadline you will have to face some hefty penalties. The penalty amount is based on the size of your organization and how many days your return is later. As the later your form becomes, the higher your penalty grows. Penalty amounts range from $50 to $1,113,000.

Form W-9: Request for Taxpayer Identification Number and Certification

Invite your vendors to complete and e-sign W-9

Form W-9 is an IRS tax form used by an individual or entity to request a person's name, address, Taxpayer Identification Number (TIN) and certification from a hired contractor or vendor to File Form 1099 information returns. IRS Form W9 is known as Request For Taxpayers Identification Number and Certification Form.

With TaxBandits online portal, employers can request w9 form online and manage all W-9 forms at one place securely. Sign up now and request the first FIVE Form W-9 for FREE.